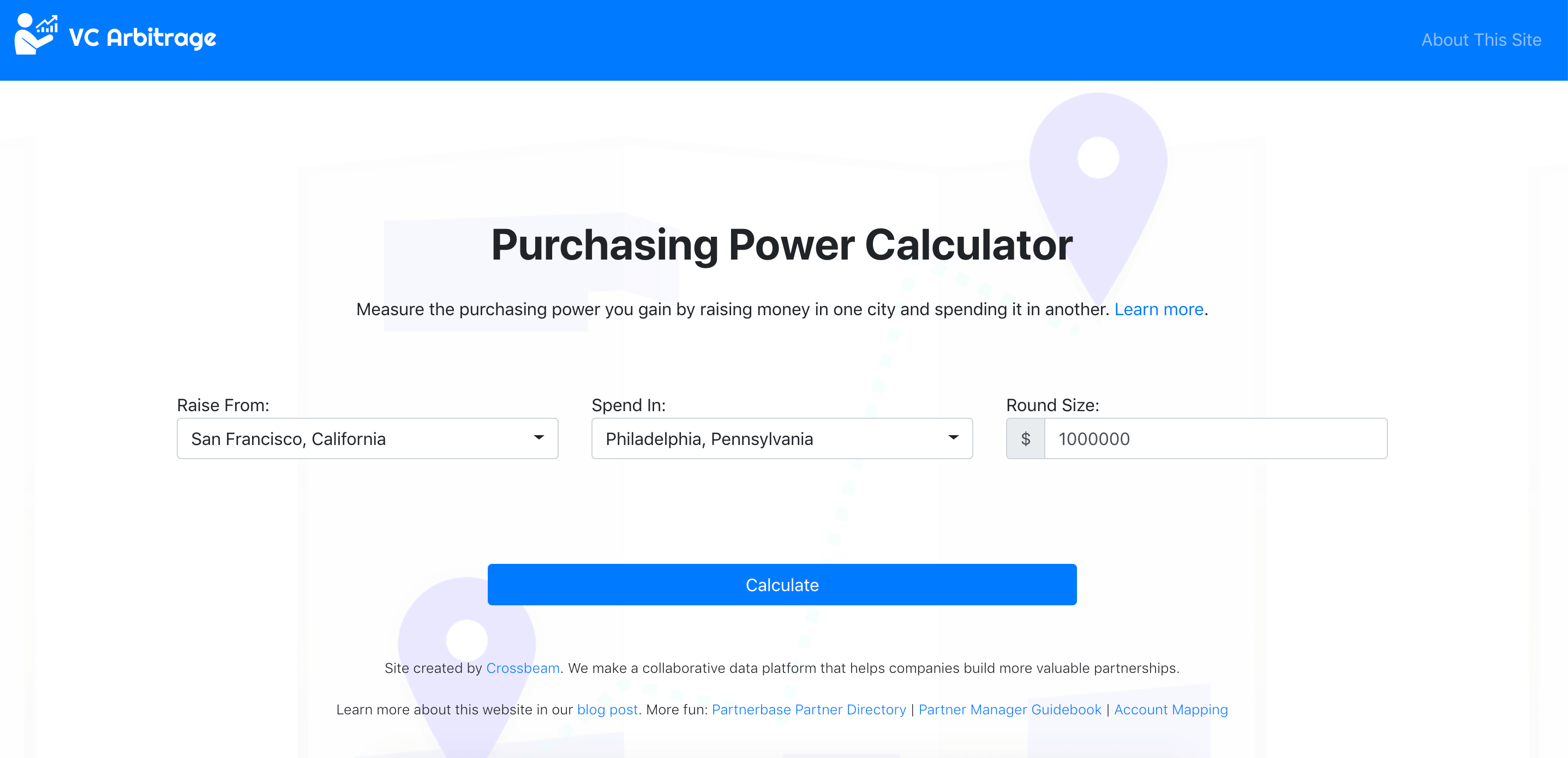

Want to see how far VC dollars go in different cities? Use our handy tool. Just plug in the cities and hit go.

Why do I launch startups in Philadelphia? I get that question a lot. Why not launch in San Francisco or Silicon Valley, home to big-time investors, talented software engineers and temperate weather? Why not dream big instead of thinking small?

I first heard this refrain 10 years ago, when Jake Stein and I founded RJMetrics in Philly. It was a long journey that culminated with a sale to Magento (now part of Adobe) in 2016. Soon after, Talend acquired our two-year-old spinout Stitch for $60 million. Philly was good to us.

Earlier this month, when Buck Ryan and I launched Crossbeam and announced a $3.35M seed funding round, there it was again: Why on earth did I launch it in Philadelphia? I’m not married. No kids. Why don’t I pack up shop and take my shot at Silicon Valley greatness?

This is the part where touchy-feely stuff about community, family, and grit tend to take center stage. Not for me. I’m a data guy, so I just ran the numbers.

Purchasing Power

Fans of The 4-Hour Workweek author Tim Ferriss know this concept well, as it has inspired countless “digital nomads” who earn a U.S. salary and live internationally where their dollar packs a bigger punch. A junior engineer earning $60k can live like royalty in Thailand on the same salary that would have them splitting a studio apartment in SF.

The catch is that you have to be able to sell high and buy low. In the case of remote work, you are selling your hours at U.S. rates, and buying goods and services at Southeast Asia prices.

What if you approached venture capital fundraising the same way? Sell your stock in a market where prices are the absolute highest, then spend that money in a market where the prices are as low as possible. That’s my playbook, and it works thanks to two simple truths:

- Variable purchasing power: Outside of San Francisco, where the cost of living is lower and the inputs to startup operations are less constrained, a dollar goes further.

- Consistent valuations: Most venture capital investors are based in the San Francisco Bay Area and deploy a large percentage of their capital into that market. Therefore the “market” deal terms (i.e., valuations) in that area serve as a benchmark for how all deals get done, regardless of where the startup is based.

In my personal experience, which includes over $100M of transactions involving dozens of investors over the past eight years, both of these assumptions have consistently proven true.

It’s VC arbitrage.

The Math

Here’s the fun part: all the numbers you see in this section can be run automatically for your city (not just Philly) by checking out this site I built called VC Arbitrage. Check it out when you’re done reading.

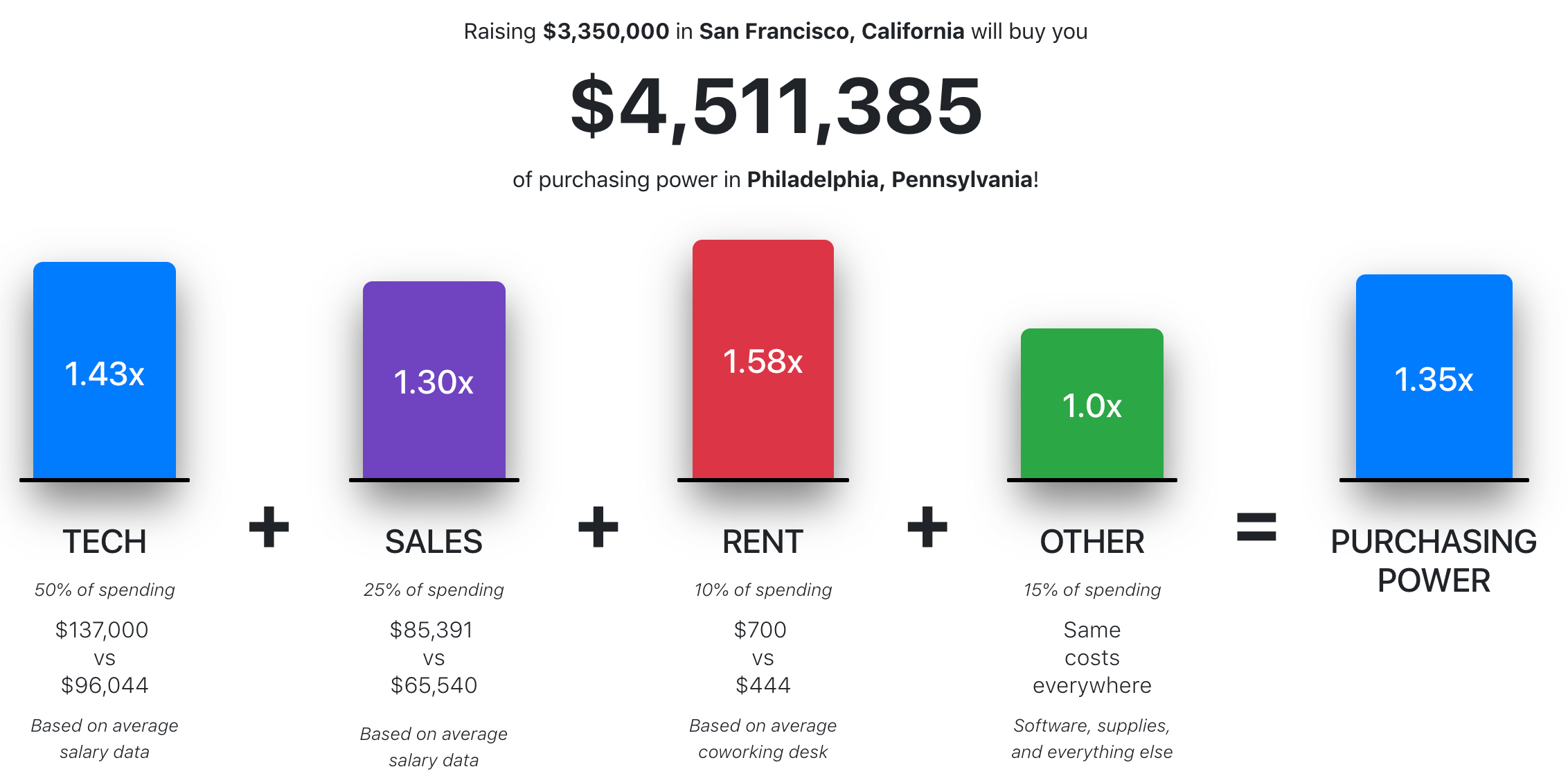

It’s not hard to find “cost of living” comparison calculators for top cities in the U.S. But startups don’t spend money like the average consumer. The cost of residential rent and a gallon of milk are indirect inputs to startup costs at best, while things like the cost of coworking desks and entry level engineers are a far better proxy.

I looked through the early-stage cost models from RJMetrics, Stitch, and Crossbeam to pull together a rough breakdown of how expenses were allocated among different cost categories in the early stages of growth.

50% – Engineering Headcount

By far the largest expense at the early stages, engineering headcount is disproportionately high as the product is being developed and a company iterates to product-market fit. Data was pulled from public averages on Glassdoor and Indeed.

25% – Sales and G&A Headcount

At later stages, it’s not uncommon for sales headcount to overtake engineering, but on a blended basis this relative allocation was most accurate. We also lumped general and administrative expenses into this bucket as sales salaries were a more fair proxy for general salary ratios for non-engineering roles. Data was pulled from public averages on Glassdoor and Indeed.

10% – Rent

We used the average price of a dedicated desk in a coworking space as a proxy for rent. The data was pulled from published pricing, reports from real estate firms, and, in some cities, by calling coworking spaces to get prices.

15% – Cost of Goods Sold (COGS) and Other Expenses (software licenses, etc.)

Some things just don’t change with geography. Cloud servers, software licenses, computer hardware, etc. Anything in this “other” bucket we stuck at a 1:1 ratio and assumed no purchasing power benefit.

The results for my $3.35M round that was raised in San Francisco and will be spent in Philadelphia is calculated below:

Penny Wise and Pound Foolish?

I know what some of you are thinking — this argument is pennywise and pound foolish. The intangible benefits of being physically close to your investors, customers, and mentors far outweigh picking up a few extra bucks in purchasing power.

This is a fair argument, but with every year that goes by it packs less of a punch. Here’s why:

- Startup ecosystems in second-tier cities are maturing rapidly. The resources, talent, and mentor networks in these cities have made major strides in the past decade and many of the table-stakes roadblocks that hurt companies when these environments were more fledgling are going away.

- Remote work is more common. For companies based outside of major tech hubs, it’s easier than ever to establish mentoring relationships, have heart-to-heart chats with investors, and work asynchronously thanks to major innovation in the tools and practices around how work is done.

- For more experienced founders, many of the benefits that come from proximity are less important. Many are crutches that hold up companies as they build operating discipline.

I am certain that there are companies out there who would be much better served by packing up and moving to the Bay Area. The math just doesn’t make sense for me, and it’s up to each founder to run their own numbers.

Until then, see you on the redeye!

Turn your ecosystem into your #1 revenue source

Get started in under a minute. Instantly capture insights from your partners. Identify more opportunities. Did we mention it’s free?