Partner Conflict is the general term for when two or more partners are inhibiting each other’s ability to close a deal. It takes two forms:

- Tech Partner Conflict

- Channel Conflict

Partner Conflicts are an existential threat to a SaaS company’s partner ecosystem and often result in wasted time and resources. On occasion, a conflict can result in the loss of a partnership, or worse, a customer. For partner managers, identifying and preventing Partner Conflicts is key to growing your programs and keeping your partners happy.

In this post we’ll cover:

The types of partnerships and conflicts

How to avoid Channel and Tech Partner Conflict

- Option #1: Swap spreadsheets

- Option #2: Use a PRM to manually register leads and spot conflict

- Option #3: Use data escrow to eliminate Partner Conflict entirely

The types of partnerships and conflicts

Broadly speaking, SaaS companies typically have two kinds of partnerships and each is affected by Partner Conflict in its own way:

- Technology partners (sometimes referred to as “integration partners”) are fellow product companies offering a technology integration to your product (or vice versa).

- Channel partners are go-to-market partners who resell, refer, or implement your product to their customer base.

Most mature SaaS companies offer both kinds of these partnerships. For example, see billing platform Chargify’s partner page:

Both channel and tech partnerships can suffer from conflict.

Both channel and tech partnerships can suffer from conflict.

Technology Partner Conflict

Technology partners are other apps or products that incorporate some of your functionality in their service, or vice versa. A technology partnership is often bi-directional with both services integrating with each other. Technology partners are sometimes referred to as Independent Software Vendors (ISVs), platform partners, integration partners, or application partners.

As a customer, you’re probably familiar with this. Amazon and Nest have a tech partnership so you can ask your Alexa to “Set the living room to 67 degrees” and Alexa knows to signal your Nest to lower the temperature.

In B2B, think of something like Giphy integrating with Slack so you can have just the right reaction when it’s your coworker’s birthday. Or how Stripe integrates with Intercom to allow customers to make payments within Intercom’s chat product and Slack integrates with Salesforce to enable in-chat displays of your CRM data.

Tech Partner Conflict arrives when tech partners aren’t co-selling effectively and (often unknowingly) inhibiting each other’s selling motion.

For example, let’s say TechCo is a new startup that recently raised a Series A and it’s ready to set up its analytics operations. It needs to buy the entire stack here: an ETL (“Extract, Transform, Load”) product to move the data, a data warehouse to store the data, and a Business Intelligence (BI) platform to display and analyze the data.

To have a working analytics setup, TechCo needs all three of these products to be purchased, launched, and connected to each other. If any piece is missing, either the data won’t flow, the queries won’t run, or the dashboards won’t appear. Naturally, part of the selection process is making sure these components have tech partnerships that allow them to easily integrate into each other.

From the standpoint of the vendors, however, this makes things complicated. There are two possible ways this process could play out:

The good way: The ETL, data warehouse, and BI platforms are all tech partners. Not only do their products integrate with one another, but each company’s go-to-market teams are also coordinating with each other. They are able to detect when their sales pipelines overlap, allowing them to immediately spot TechCo in their list of shared opportunities and initiate a co-selling motion.

They present shared case studies of how their platforms integrate, present education on how to best implement the tech stack, and their sales reps communicate in their partner Slack channel about how the deal is progressing on each side. The deal is done in weeks, all the vendors win the business, and the end user has a smooth buying experience. Everyone buys ice cream afterward.

The bad way: The ETL, data warehouse, and BI platforms are all tech partners with little visibility into one another’s pipeline. TechCo reaches out to all three and each sales rep initiates a totally separate selling process. Each vendor has no visibility into the other conversations that are in play with its partners. Each rep is navigating its own contract, pricing, demos, positioning, etc, without the benefit of partner context. The deal can only move as fast as the slowest partner and the deal takes months — or worse never happens because another group of tech partners is able to move fast.

Channel Partner Conflict

Channel partners are entities that resell your offering or refer customers, acting as an outsourced sales team of sorts. Types of channel partners can include Value Added Resellers (VARs), resellers, Systems Integrators (SIs), BPO (Business Process Outsourcers), sales partners, affiliate partners, and Managed Service Providers (MSPs).

With so many entities and resellers out there, Channel Conflicts are common. Here’s an example: You are FancyTool, and you make payroll software. Your direct sales team receives a demo request from BigCo, Inc. and begins nurturing a relationship. Two weeks in, you discover that one of your resellers, a channel partner, has been in a two-month sales process to sell your same product to BigCo. Your direct team has unknowingly been competing against your channel partners—who are supposed to be representing your interests.

Late in the sales process, both teams realize what’s going on and now your sales leadership is in hot water. Does the reseller or your rep get commission? Have they inadvertently pushed down the price BigCo is paying by bidding against each other? Will the company need to double-pay for the sale by paying your rep commission and the reseller their referral fee?

If your sales team had known about the reseller’s ongoing sales process, they wouldn’t have sunk the effort and energy into their own conflicting sales process, and everyone would be celebrating this new deal instead of waging war for credit. What a waste of time and resources!

How to avoid Channel and Tech Partner Conflict

Partner Conflict is, at its heart, a data problem. It arises when all parties don’t have visibility into the data needed to make decisions about sales, pricing, and marketing. To mitigate this, there are three options:

Option #1: Swap spreadsheets

Each partner has their own sales workflow, with its own set of SaaS tools to manage. The Rosetta Stone that can connect them all is the spreadsheet. Sorta.

You could ask all of your partners to export their pipeline in an Excel-friendly format to gain visibility by mapping the accounts.

If you’re collaborating with a tech partner:

The overlaps mean there is a potential for a co-selling motion to avoid a Tech Partner Conflict.

If you’re collaborating with a channel partner:

The overlaps mean there is a potential for Channel Conflict.

Using spreadsheets to solve these issues is common, but there are several issues:

- It’s frozen in time. The spreadsheet is static and is out-of-date the moment it is exported. You won’t have visibility into your partner’s pipeline until the next spreadsheet swap.

- Security concerns. When you send a spreadsheet of pipeline info, you can never be sure who will use or misuse it—or if someone forwards it along.

- Oversharing. Sharing spreadsheets usually exposes all of your records, not just where there are actionable overlaps. This leaves you with two bad options: overshare in order to find all the overlaps or undershare and risk missing them.

- Matching is hard. Most people use manual inspection or VLOOKUP functionality to see which values overlap between their spreadsheet and their partner’s spreadsheet. This causes issues with false positives and false negatives that can cause you to miss opportunities and create embarrassing mistakes. This is the primary driver of partner manager coffee consumption.

Option #2: Use a PRM to manually register leads and spot conflict

A Partner Relationship Manager tool or “PRM” is software where, among other things, a reseller can fill out a form to submit a lead to the SaaS company. If the SaaS company is able to turn that lead into a sale, the reseller gets credit and commission.

If you’re collaborating with a tech partner: PRM systems were built with channel partnerships in mind and do far less to help facilitate effective tech partnerships. The nature of tech partnerships can make them incompatible with a PRM-based lead registration processes.

If you’re collaborating with a channel partner: This process allows a SaaS company to see the incoming lead and match it with any active selling motions to lessen the chance of channel conflict. Unfortunately, the process for approving or denying a lead is manual and sometimes happens late in the sales process. It is not entirely effective in preventing conflict.

Option #3: Use data escrow to eliminate Partner Conflict entirely

New technology in the partnership software space includes data escrow functionality. Using it, you and your partners can each securely house data about your customers and prospects, only sharing information with each other when there are overlaps (and only the details you select). Seeing as this is the Crossbeam blog, we’ll show you how this works using Crossbeam’s data escrow capabilities.

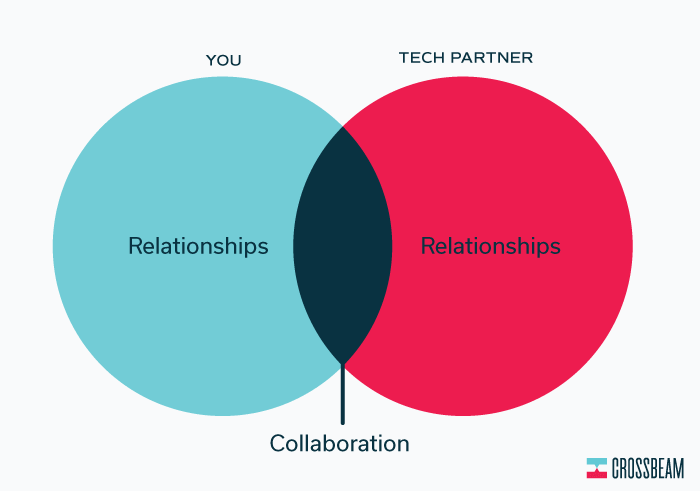

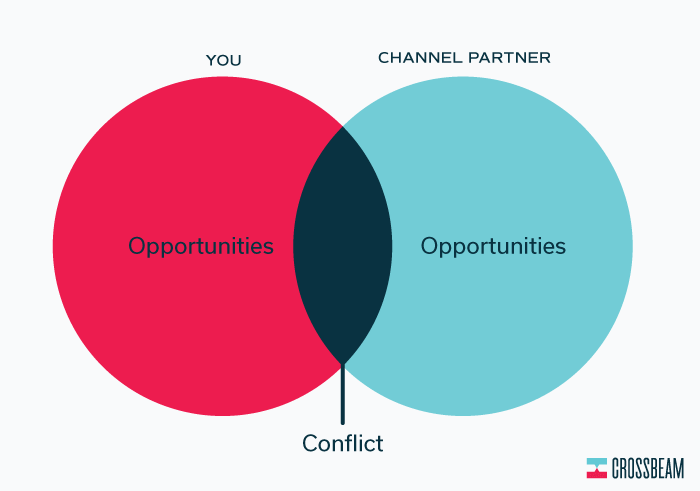

Have your partners connect their information to Crossbeam, set the proper permissions, then use the overlaps to understand where there is potential for conflict. It’s a Venn Diagram of sorts: Where there are overlaps, there are shared relationships that need to be managed in order to avoid conflict or initiate a co-selling motion.

Here’s an example of what that looks like. In this example, we are mapping my opportunities to the opportunities of my partner, Sabre. I see we have 14 overlaps. I can explore more about the overlap by clicking an individual record.

From here, my next steps depend on whether Sabre is a tech partner or a channel partner.

If Sabre is a tech partner: These 14 overlaps are a chance to initiate a co-selling motion. I can…

- Connect the reps so they help, rather than interfere with, each other’s deal.

- Share backchannel insights on the company.

- Co-sell and send custom collateral/positioning about how to use our two products together.

- Monitor deals through my pipeline and the pipeline of my partner so I know where to attribute partner influence.

If Sabre is a channel partner: these 14 overlaps are in danger of being subject to Channel Conflict. I can…

- Instruct my rep to no longer pursue the opportunity and implement a reseller sales support motion.

- I can introduce the two reps to initiate a co-selling motion.

- I can instruct my channel partner to stop considering this opportunity and instead implement a direct selling motion.

You can sign up for a free Crossbeam account here.

Turn your ecosystem into your #1 revenue source

Get started in under a minute. Instantly capture insights from your partners. Identify more opportunities. Did we mention it’s free?